Washington,(Amendment (Amendment No. )☐ Preliminary Proxy Statement ☐ ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Targa Resources Corp.(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box):☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.(1)Title of each class of securities to which transaction applies:(2)Aggregate number of securities to which transaction applies:(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):(4)Proposed maximum aggregate value of transaction:(5)Total fee paid:☐Fee paid previously with preliminary materials. ☐ Fee computed on table in exhibit required by Item 25(b) Check box if any part of the fee is offset as provided byRule 0-11(a)(2) Rules identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.(1)Amount Previously Paid:(2)Form, Schedule or Registration Statement No.:(3)Filing Party:(4)Date Filed:

TARGA RESOURCES CORP.

811 Louisiana Street

|Suite 2100

|Houston, Texas 77002

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Targa Resources Corp.:

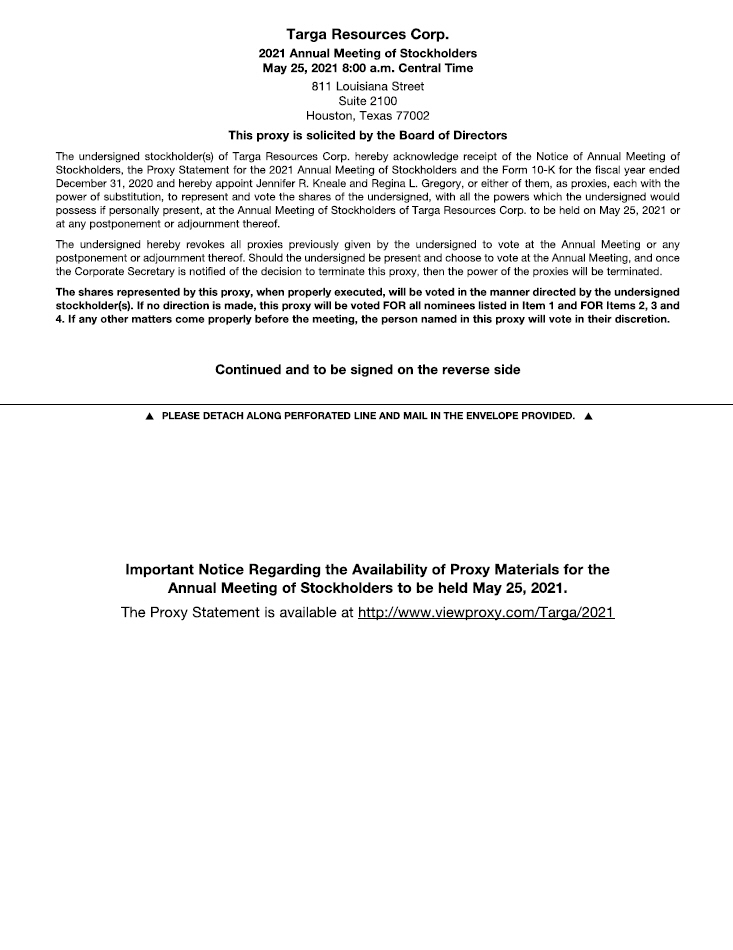

Notice is hereby given that the Annual Meeting of Stockholders of Targa Resources Corp. (the “Company” or “Targa”) will be held at 811 Louisiana Street, Suite 2100, Houston, TX 77002 on May 25, 2021,16, 2024, at 8:00 a.m. Central Time (the “Annual Meeting”). The Annual Meeting is being held for the following purposes:

| 1. | To elect the |

| 2. | To ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for |

| 3. | To approve, on an advisory basis, the compensation of the Company’s named executive officers for the fiscal year ended December 31, |

| 4. |

|

To transact such other business as may properly come before the Annual Meeting. |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting only if you were a stockholder of record at the close of business on March 29, 2021.19, 2024.

YOUR VOTE IS IMPORTANT

Please vote over the internet at www.AALVote.com/TRGP or by phone at 1-866-804-9616 promptly so that your shares may be voted in accordance with your wishes and so we may have a quorum at the Annual Meeting. Alternatively, if you did not receive a paper copy of the proxy materials (which includes the proxy card), you may request a paper proxy card, which you may complete, sign and return by mail.

By Order of the Board of Directors,

| By Order of the Board of Directors, | ||||

| ||||

Gerald R. Shrader | Houston, Texas | |||

| SECRETARY | March 21, 2024 | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 25, 2021:May 16, 2024:

OUR PROXY STATEMENT FOR THE 20212024 ANNUAL MEETING OF STOCKHOLDERS AND OUR ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT http:HTTP://www.viewproxy.com/Targa/2021.WWW.VIEWPROXY.COM/TARGA/2024.

TABLE OF CONTENTS

TARGA RESOURCES CORP.

(the “Company”)

811 Louisiana Street

Suite 2100

Houston, Texas 77002

PROXY STATEMENT

2021

TARGA RESOURCES CORP. (the “Company”)

811 Louisiana Street | Suite 2100 | Houston, Texas 77002

PROXY STATEMENT

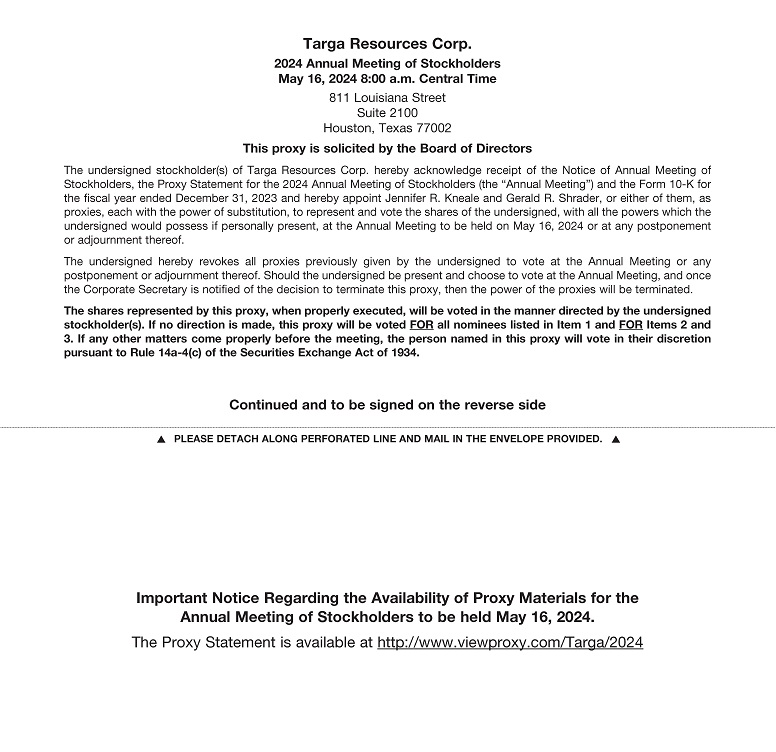

2024 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors of the Company (the “Board of Directors” or “Board”) is providing the information in this proxy statement to you in connection with the solicitation of proxies for the matters to be voted on at the Annual Meeting of Stockholders (the “Annual Meeting”) that will be held May 25, 2021,16, 2024, at 8:00 a.m. Central Time, at 811 Louisiana Street, Suite 2100, Houston, TX 77002. By submitting your proxy card, you authorize the persons named on the proxy card to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting.

We encourage you to vote your shares prior to the Annual Meeting. If you attend the Annual Meeting, you may vote in person. Only stockholders of the Company (or their authorized representatives) and the Company’s invited guests may attend the Annual Meeting. All attendees should be prepared to present government-issued photo identification (such as a driver’s license or passport) for admittance. If you are not present at the Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy. You may revoke your proxy in writing at any time before it is exercised at the Annual Meeting by delivering to the Secretary of the Company a written notice of the revocation, by submitting your vote electronically through the internet or by phone after the grant of your proxy, or by signing and delivering to the Secretary of the Company a proxy card with a later date. Your attendance at the Annual Meeting will not revoke your proxy unless you give written notice of revocation to the Secretary of the Company before your proxy is exercised or unless you vote your shares in person at the Annual Meeting.

We intend to hold theElectronic Availability of Proxy Statement and Annual Meeting in person. However, we are continuing to actively monitor the coronavirus (COVID-19) pandemic and related governmental restrictions; we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication. Please monitor our Annual Meeting website at http://www.viewproxy.com/Targa/2021 for updated information.

ELECTRONIC AVAILABILITY OF PROXY STATEMENT AND ANNUAL REPORTReport

As permitted under the rules of the Securities and Exchange Commission (the “SEC”), the Company is making this proxy statement and its Annual Report on Form 10-K available to its stockholders electronically via the internet. The Company is sending on or about April 8, 2021,March 21, 2024, a Notice Regarding the Availability of Proxy Materials (the “Notice”) to its stockholders of record as of the close of business on March 29, 2021,19, 2024, which Notice will include (i) instructions on how to access the Company’s proxy materials electronically, (ii) the date, time and location of the Annual Meeting, (iii) a description of the matters intended to be acted upon at the Annual Meeting, (iv) a list of the materials being made available electronically, (v) instructions on how a stockholder can request to receive paper or e-mail copies of the Company’s proxy materials, (vi) any control/identification numbers that a stockholder needs to access his or her proxy card and instructions on how to access the proxy card, and (vii) information about attending the Annual Meeting and voting in person.

1

Stockholders of Record and Beneficial Owners

Most of the Company’s stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of Record.Record. If your shares are registered directly in your name with the Company’s transfer agent, you are considered the stockholder of record with respect to those shares, and the Notice is being sent directly to you by our agent. As a stockholder of record, you have the right to vote by proxy or to vote in person at the Annual Meeting. If you received a paper copy of the proxy materials by mail instead of the Notice, the proxy materials include a proxy card for the Annual Meeting.

Beneficial Owners. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the Notice will be forwarded to you by your bank, broker or nominee. The bank, broker or nominee is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker how to vote. Beneficial owners that receive the Notice by mail from the stockholder of record should follow the instructions included in the Notice to

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 3 |

view the proxy statement and transmit voting instructions. If you received a paper copy of the proxy materials by mail instead of the Notice, the proxy materials include a voting instruction card for the Annual Meeting. To vote electronically over the Internetinternet or by telephone, you should follow the instructions provided to you by your bank, broker or other nominee.

If you are a beneficial owner and want to vote your shares at the Annual Meeting, you will need to ask your bank, broker or other nominee to furnish you with a legal proxy. You will not be able to vote your shares at the Annual Meeting without a legal proxy provided by your bank, broker or other nominee.

If you are a beneficial owner, you must follow the instructions provided to you by your bank, broker or other nominee to revoke prior voting instructions. Your attendance at the Annual Meeting will not revoke your vote unless you obtain a legal proxy from your bank, broker or other nominee and you vote your shares in person at the Annual Meeting.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 4 |

2

QUORUM AND VOTING

Voting Stock. The Company’s common stock, par value $0.001 per share (“common stock”), is the only class of securities that entitles holders to vote generally at meetings of the Company’s stockholders. Each share of common stock outstanding on the record date is entitled to one vote. Following the Annual Meeting, voting results will be tabulated and certified by the inspector of elections appointed by the Board and timely announced by the Company.

Record Date.Date. The record date for stockholders entitled to notice of and to vote at the Annual Meeting will be the close of business on March 29, 2021.19, 2024. As of the record date, there were a total of 228,654,590222,535,258 shares of common stock outstanding and entitled to be voted at the Annual Meeting.

Quorum and Adjournments. Adjournments. The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote generally in the election of directors at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

If a quorum is not present, a majority of the stockholders entitled to vote who are present in person or by proxy at the Annual Meeting have the power to adjourn the Annual Meeting from time to time, without notice other than an announcement at the Annual Meeting,as required by applicable law, until a quorum is present. At any adjourned Annual Meeting at which a quorum is present, any business may be transacted that might have been transacted at the Annual Meeting as originally notified.

Vote Required. The votes required to pass each proposal is as follows:

Proposal | Required Vote for Approval | Broker Discretionary

| Impact of Abstentions | |||

ONE (Election of | The affirmative vote of a majority of the votes cast by the holders of shares entitled to vote with respect to that director’s election (meaning that the number of the votes cast “for” a director’s election must exceed the number of the votes cast “against” that director’s election). | Brokers do not have discretionary authority to vote on this proposal.

Broker non-votes are not considered votes cast and do not affect the outcome. | Abstentions are not considered votes cast and do not affect the outcome. | |||

TWO (Ratification | The affirmative vote of a majority of the shares present and entitled to | Brokers have discretionary authority in the absence of timely instructions from their customers to vote on this proposal. As a result, there will be no broker non-votes with respect to this proposal. | Abstentions are treated as present and entitled to vote on the matter and will have the same effect as a vote against this proposal. | |||

THREE (Advisory of Named | The affirmative vote of a majority of the shares present and entitled to

This advisory vote is not binding on the Company, the Compensation Committee or the Board. However, the Compensation Committee and the Board will take into account the result of the vote when determining future executive compensation programs. | Brokers do not have discretionary authority to vote on this proposal.

Broker non-votes are not entitled to vote and do not affect the outcome. | Abstentions are treated as present and entitled to vote on the matter and will have the same effect as a vote against this proposal. | |||

3

|

|

|

| |||

If your shares of common stock are held in the name of a bank, broker or other holder of record, you will receive instructions from that holder of record that you must follow in order for your shares to be voted at the Annual Meeting. Brokers who hold shares in street name for customers are required to vote shares in accordance with instructions received from the beneficial owners.

Default Voting.Voting. A proxy card that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy card. If you properly complete and submit a proxy card, but do not indicate any contrary voting instructions, your shares will be voted consistent with the Board of Directors’ recommendation as follows:

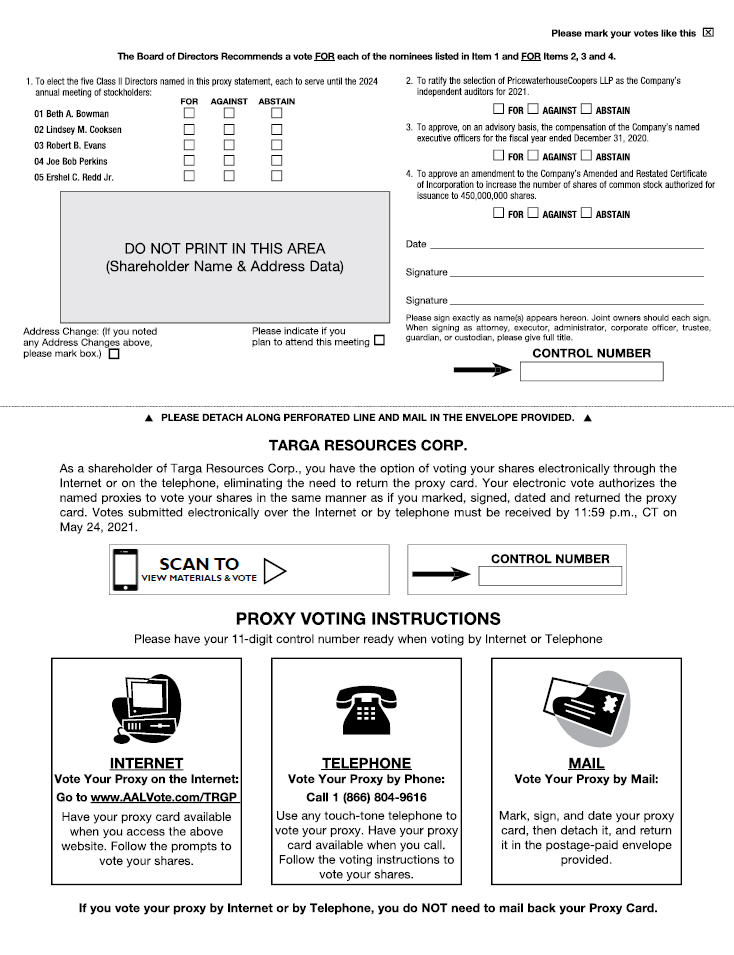

FOR the election of the five persons named in this proxy statement as the Board of Directors’ nominees for election as Class II Directors, each to serve until the 2024 annual meeting of stockholders.

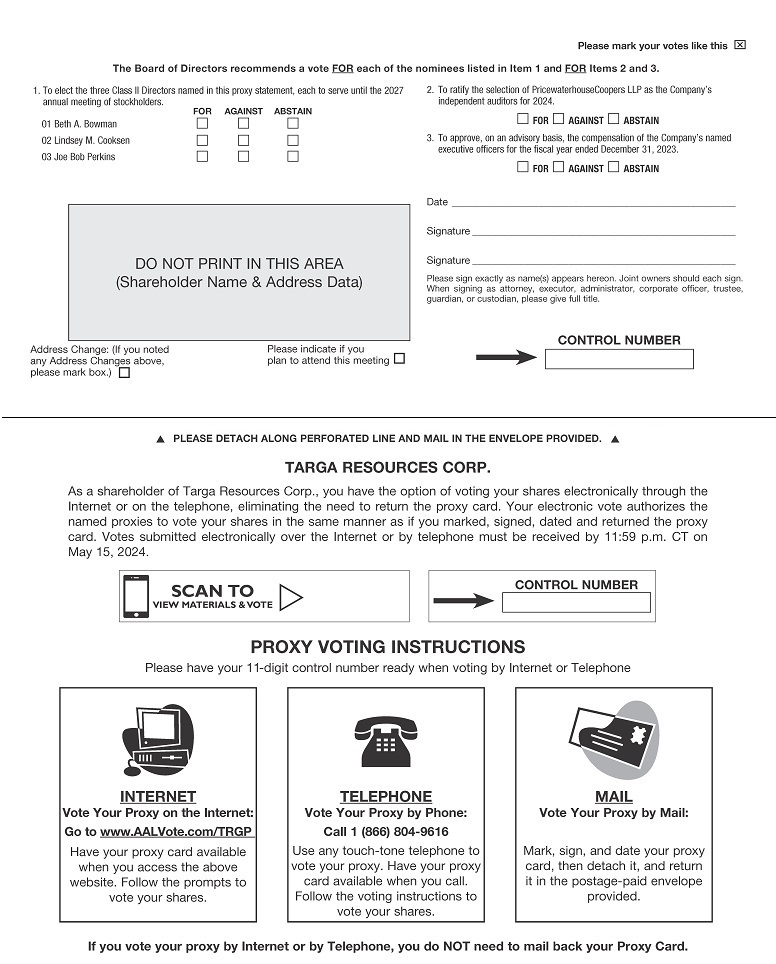

| ∎ | FOR the election of the three persons named in this proxy statement as the Board of Directors’ nominees for election as Class II Directors, each to serve until the 2027 annual meeting of stockholders (Proposal One). |

FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2021.

| ∎ | FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2024 (Proposal Two). |

FOR the approval, on an advisory basis, of the compensation of our named executive officers for the fiscal year ended December 31, 2020, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC.

FOR the approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of shares of common stock authorized for issuance to 450,000,000 shares.

| ∎ | FOR the approval, on an advisory basis, of the compensation of our named executive officers for the fiscal year ended December 31, 2023, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the SEC (Proposal Three). |

If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted in accordance with the discretion of the holders of your proxy. The Board of Directors knows of no matters, other than those previously stated, to be presented for consideration at the Annual Meeting.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 6 |

4

SUSTAINABILITY AND ESGBUSINESS OVERVIEW

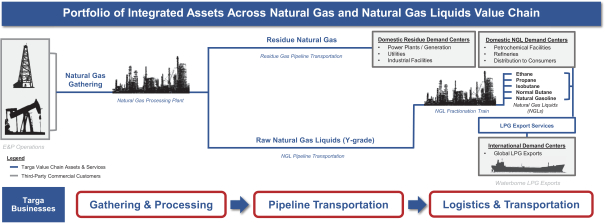

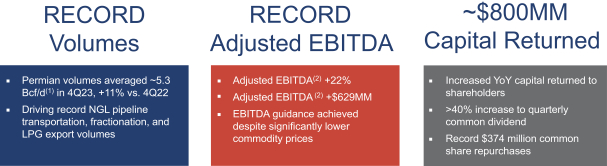

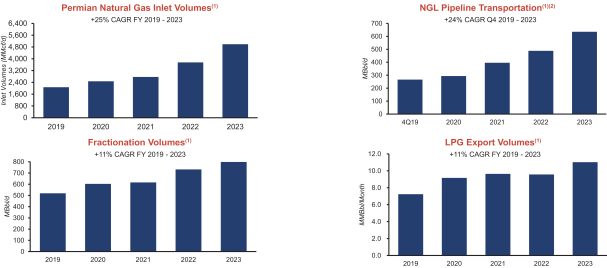

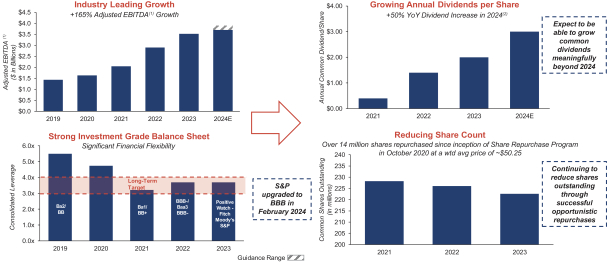

At Targa (NYSE: TRGP) is a publicly traded Delaware corporation formed in October 2005. Targa is a leading provider of midstream services and is one of the largest independent midstream infrastructure companies in North America. We own, operate, acquire, and develop a diversified portfolio of complementary domestic midstream infrastructure assets.

Our Operations

We are engaged primarily in the business of:

| ∎ | gathering, compressing, treating, processing, transporting, and purchasing and selling natural gas; |

| ∎ | transporting, storing, fractionating, treating, and purchasing and selling natural gas liquids (“NGLs”) and NGL products, including services to LPG exporters; and |

| ∎ | gathering, storing, terminaling, and purchasing and selling crude oil. |

To provide these services, we striveoperate in two primary segments: (i) Gathering and Processing, and (ii) Logistics and Transportation (also referred to conduct our business safelyas the Downstream Business).

Our Gathering and with integrity, creating lasting benefitsProcessing segment includes assets used in the gathering and/or purchase and sale of natural gas produced from oil and gas wells, removing impurities and processing this raw natural gas into merchantable natural gas by extracting NGLs; and assets used for our stakeholders, including investors, lenders, customers, employees, business partners, regulators,the gathering and terminaling and/or purchase and sale of crude oil. The Gathering and Processing segment’s assets are located in the Permian Basin of West Texas and Southeast New Mexico (including the Midland, Central and Delaware Basins); the Eagle Ford Shale in South Texas; the Barnett Shale in North Texas; the Anadarko, Ardmore, and Arkoma Basins in Oklahoma (including the SCOOP and STACK) and South Central Kansas; the Williston Basin in North Dakota (including the Bakken and Three Forks plays); and the communities in which we liveonshore and work. We are proud to be partnear offshore regions of the energy infrastructure that is delivering safe, reliable energy to industry, farmers,Louisiana Gulf Coast and communities across America.the Gulf of Mexico.

Our operations connect U.S.Logistics and Transportation segment includes the activities and assets necessary to convert mixed NGLs into NGL products and also includes other assets and value-added services such as transporting, storing, fractionating, terminaling, and marketing of NGLs and NGL products, including services to LPG exporters and certain natural gas supply and marketing activities in support of our other businesses. The Logistics and Transportation segment also includes the Grand Prix NGL Pipeline, which connects our gathering and processing positions in the Permian Basin, Southern Oklahoma and North Texas with our Downstream facilities in Mont Belvieu, Texas. Our Downstream facilities are located predominantly in Mont Belvieu and Galena Park, Texas, and in Lake Charles, Louisiana.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 7 |

SUSTAINABILITY AT TARGA

Targa Resources Corp. is one of the largest independent midstream infrastructure companies in North America. As a predominately natural gas and natural gas liquids (NGL) supply to markets where there is growing demand for cleaner fuel and feedstocks. We believe that natural gas, NGLs and liquefied petroleum gas (LPG) are part of the solution to reducing the world’s greenhouse gas emissions. Natural gas, NGLs, and LPG are playing a meaningful role globally in improving public health and the environment with about half of the carbon dioxide (CO2) emissions compared to coal combustion. The increasing use of natural gas has helped the U.S. lower its emissions even as the economy has grown over the last 15 years. Globally, where electricity is not available, the use of LPGs for fuel has a positive impact on the health and prosperity for local people in less industrialized nations.

Safety - At Targa, safety is a core value. We believe that “Zero is Achievable” and our goal is to operate and deliver our products without any injuries. We continually seek to maintain and deepen our safety culture by providing a safe working environment that encourages active employee engagement. To protect our employees, contractors, and surrounding community from workplace hazards and risks, Targa implements and maintains an integrated system of policies, practices, and controls.

Operational Excellence - We recognize that operating our assets, including thousands of miles of pipelines, natural gas processing facilities, and NGL fractionation and distribution facilities, is a great responsibility. Throughout our organization,focused energy infrastructure company, we are committed to maintaining our reputation as a responsible and operating ourreliable operator of critical energy infrastructure.

We strive to safely and reliably operate a strong and diversified portfolio of gathering, processing, logistics, and transportation assets. Our assets connect natural gas and NGLs to domestic and international markets as part of an integrated energy value chain that is designed to deliver affordable and reliable energy for everything from electricity, dependable home heating and cooling, transportation fuel, and products that touch lives every day.

Targa’s products help to provide necessary, affordable, reliable, and dependable sources of energy and feedstocks that meet the world’s growing energy demand. We believe that, for many in the world today, natural gas and NGLs help provide critical access to the infrastructure, employment, clean water and food, education, and healthcare that all people deserve. Our mission is to safely efficiently, anddeliver energy, including to energy-poor areas of the world, in ana more environmentally responsible manner. We invest each year in integrity management, maintenance,way, caring for and environmental programs. Wherever we operate, we strive to conduct our business with attention tobeing stewards of the environment and to manage risks to enable sustainable business growth.environment.

Integrity and CodeAs part of Conduct - Our actions are guided by Targa’s Code of Conduct, the overarching policy that empowers us to commit to ethics, integrity, and compliance. Targa’s Code of Conduct establishes the high standard of ethical conduct that our employees are expected to follow and outlines how everyday behavior is expected to align with our core values. We further reinforce our commitment through adherence to our policies and practices, as well as through Code of Conduct annual training.

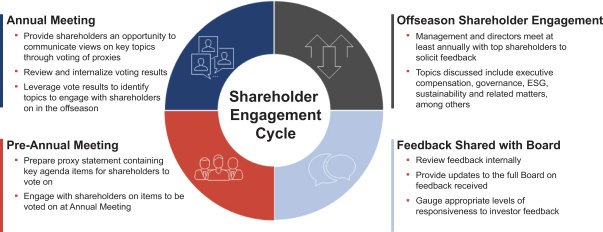

Throughout our organization, we are committed to operating safely, with excellence and high integrity. This is a commitment that starts with and is maintained by our Board of Directors, where the full Board holds the senior management team accountable for implementing our sustainability and Environmental, Social and Governance (ESG) objectives, including through administration of the Company’s annual incentive program.

ESG and sustainability remain a core Board agenda item, with metrics and focus topics discussed at each quarterly meeting led by different members of the cross-functional team supporting our ESG efforts. Our performance on sustainability factors played a role in 2020 compensation decisions and will continue to play a role in the Compensation Committee’s evaluation of annual incentive compensation. To further develop and advance our goals and approachDirectors’ continued commitment to sustainability, Targa has a cross-functional sustainability working group comprised of leadership from our Environmental, Safety and Health, Operations, Engineering, Human

5

Resources, Legal, Supply Chain, Financial Accounting, Commercial, and Investor Relations departments. The coordinated efforts are led by our Senior Vice President of Sustainability and Environmental, Safety and Health (ES&H), who reports directly to our Chief Executive Officer. Our sustainability efforts are designed to generate attractive economic returns for our investors, while minimizing environmental and social impacts.

Furthermore, the Board has established a Sustainability Committee to assist the Board in overseeing our compliance with all laws, regulationsoversees environmental, social, and Company policies and procedures related to material ESGsustainability matters, including governance in relation to such matters, and overseeingmatters. One of the committee’s purposes is to oversee management’s process for establishing and implementing a strategy to integrate sustainability into various business activities of the Company, with the goal of creating long-term stakeholder benefits. The full Board of Directors also reviews the Company’s progress at each quarterly board meeting. Our CEO and Executive Management team, including our Senior Vice President of Sustainability, oversee the development, implementation, and reporting of our environmental, social, and governance (“ESG”) practices, and facilitate our enterprise risk management (“ERM”) process with participation and oversight from the Board of Directors.

Our Performance

We continue to engage with our stakeholders regarding our ESG efforts, and are proud of the progress we have made.

First, across multiple safety metrics, Targa continues to achieve our best safety performance in years, due in large part to multiyear investment in and implementation of standardized processes and digital systems, training programs, and proactive work practices. In 2022, we achieved a 26% reduction in Total Recordable Incident Rate compared to 2021, completed more than 44,000 total safety and environmental training hours, and conducted 69 formal safety audits and investigations. We strive to make safety part of everything we do and who we are as a company; for example, although we recently acquired two new businesses, we still improved our overall safety record.

Additionally, Targa continues efforts to demonstrate on-going commitment to and leadership in methane management and limiting methane loss in our systems, which includes:

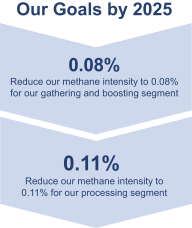

| ∎ | Committing to reduce our methane intensity to 0.08% for our gathering and boosting segment and to 0.11% for our processing segment by 2025 as part of our membership in Our Nation’s Energy Future (ONE Future), a goal we are already well on our way to meeting with a total company methane intensity performance of 0.087% as of December 31, 2022 compared to the ONE Future goal of 0.19%; |

| ∎ | Conducting aerial methane surveys for all of our assets, including twice in the Permian in 2023; |

| ∎ | Performing voluntary optical gas imaging for methane leak detection quarterly at all of our compressor stations and bi-monthly at all of our gas plants; |

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 8 |

| ∎ | Creating a cross-functional Methane Team to study our operations, work with third-party power providers, and collaborate with engine manufacturers to reduce our methane emissions; |

| ∎ | Piloting continuous methane monitoring equipment at multiple facilities; |

| ∎ | Executing power purchase agreements for long-term solar and wind in the Permian; |

| ∎ | Installing additional electrical compression to displace the use of natural gas-fired compression as we continue to evaluate our total greenhouse gas emission reduction opportunities; |

| ∎ | Taking active leadership roles in ONE Future with a newly elected ONE Future Board member and Technical Committee co-chair; and |

| ∎ | Taking a proactive approach to mitigating flaring incidents by aiming to reduce flared volumes through a combination of strategic planning, collaboration, strong asset integrity and maintenance programs, and effective combustion techniques, while maintaining the safety and integrity of our operations. |

Further, even as we have acquired new assets, started up new gas plants, and added additional fractionation capacity, which all increased volumes on our systems, we have been able to keep our greenhouse gas (“GHG”) intensity at or below that of the previous year. Our Low Carbon Energy Ventures team is investigating new opportunities for Targa all the time, including renewable power and carbon capture and sequestration, and is exploring other ideas that complement our strengths.

As we look forward, we will continue to strive to improve our performance, conduct our business safely and with integrity, and create long-term stockholder value.lasting benefits for all of our stakeholders.

We invite you to review our recent Sustainability Report, which is available on the Company’s website at https://www.targaresources.com/sustainability.

2021 BUSINESS OVERVIEW

The transitionsustainability. However, please note that the content of Targathat report, and other materials on our website, are not incorporated into a fully integrated midstream company with scalethis proxy statement by reference. Additionally, we may provide information in this proxy statement that is not necessarily “material” under the federal securities laws for SEC reporting purposes, but that is informed by various ESG standards and asset diversity is complete, with 2020 representingframeworks (including standards for the key inflection point inmeasurement of underlying data), and the interests of various stakeholders, which may be impacted by matters outside of our corporate life cycle. Since early 2017, we placed in-service approximately $7 billioncontrol. This proxy statement also contains forward-looking statements, which may be impacted by many risks, including those identified on our most recently filed Form 10-K. Accordingly, the actual conduct of projects,our activities, including the Grand Prix NGL Pipeline (“Grand Prix”), onesetting and pursuit of the most strategic projects since our inception. We believe our assets are not easily replicated, are locatedany goals, strategies, priorities, and initiatives discussed and forecasted in many attractive and active areas of exploration and production activity and are near key markets and logistics centers. Grand Prix connects our gathering and processing positionsthis proxy statement, may differ materially in the Permian Basin, Southern Oklahomafuture. Our approach to setting, measuring and North Texas withreporting on various emissions metrics, including our downstream facilitiesemissions-related goals, may change in Mont Belvieu, Texas and further increases our competitive capabilities to provide reliable, integrated midstream services to customers. Over the longer term, we expect our growth willfuture as methodologies for such activities continue to evolve. Moreover, under current or future approaches to setting, measuring or reporting on various emissions metrics, we may not be driven byable to meet our integrated midstream service offeringgoals and the strong position of our quality assets which will benefit from production from shale plays and by the deployment of shale exploration and production technologies in both liquids-rich natural gas and crude oil resource plays that will also provide additional opportunities for our Downstream Business.targets.

As we look forward, the next phase for Targa is to optimize our existing asset base, and to continue to invest along our core integrated value chain.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 9 |

PROPOSAL ONE

ELECTION OF DIRECTORS

6

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board of Directors has nominated the following individuals for election as Class II Directors of the Company to serve for a three-year term to expire at the 20242027 annual meeting of stockholders:

Beth A. Bowman

| ∎ | Beth A. Bowman |

Lindsey M. Cooksen

| ∎ | Lindsey M. Cooksen |

Robert B. Evans

Joe Bob Perkins

Ershel C. Redd Jr.

| ∎ | Joe Bob Perkins |

Mses. Bowman and Cooksen and Messrs. Evans,Mr. Perkins and Redd are currently serving as directors of the Company. Their biographical information is contained in the “Directors and Executive Officers” section below.

The Board currently consists of twelve directors. As part of our ongoing Board succession planning, Director Ershel C. Redd Jr. will not stand for reelection and announced his retirement from the Board effective as of the date of the Annual Meeting. Mr. Redd’s decision not to stand for reelection was not the result of any disagreement with the Company or any of its affiliates on any matter relating to the Company’s operations, policies or practices. Our bylaws provide that the number of directors will be determined by the Board of Directors, and the number of directors is currently set at twelve. We will reduce the number of directors to eleven following the Annual Meeting.

The Board of Directors has no reason to believe that any of its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the Company’s directors will be reduced or the persons acting via proxy will vote for the election of a substitute nominee that the Board of Directors recommends.

Our bylaws provide that in an uncontested election, each director will be elected by the affirmative vote of a majority of the votes cast by the holders of shares entitled to vote with respect to that director’s election (meaning that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election). Pursuant to our bylaws, each incumbent director nominated for election must submit an irrevocable resignation, contingent on (i) not receiving a majority of the votes cast in an uncontested election, and (ii) acceptance of that proffered resignation by the Board of Directors in accordance with the following policies and procedures. In the event an incumbent director fails to receive a majority of the votes cast in an uncontested election, the Nominating and Governance Committee, or such other committee designated by the Board, will make a recommendation to the Board of Directors as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board of Directors will act on the proffered resignation, taking into account such committee’s recommendation, and publicly disclose its decision regarding the resignation and, if such resignation is rejected, the rationale behind the decision within ninety days following certification of the election results. Such committee, in making its recommendation, and the Board of Directors, in making its decision, each may consider any factors and other information that they consider appropriate and relevant. The director whose resignation is being considered will not participate in the deliberations of such committee or the Board of Directors with respect to whether to accept such director’s resignation. If the director’s resignation is not accepted by the Board of Directors, such director will continue to serve until his or her successor is duly elected, or until his or her earlier resignation or removal.

Vote Required

The affirmative vote of a majority of the votes cast by the holders of shares entitled to vote with respect to each director’s election is required to elect that director (meaning that the number of votes cast “for” a director’s election must exceed the number of votes cast “against” that director’s election). If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal. Please see “Quorum and Voting—Vote Required” for further information regarding the impact of abstentions and broker non-votes.

Recommendation of our Board of Directors

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 10 |

7

DIRECTORS AND EXECUTIVE OFFICERS

After the Annual Meeting, assuming the stockholders elect the nominees of the Board of Directors as set forth in “Proposal One—Election of Directors” above, the

The Board of Directors of the Company will be, and the executive officers of the Company are:

| |||||||||

| Name | Age (1) | Position | |||||||

| |||||||||

Matthew J. Meloy | 46 | Chief Executive Officer and Director | |||||||

Patrick J. McDonie | 63 | President – Gathering and Processing | |||||||

D. Scott Pryor | 61 | President – Logistics and Transportation | |||||||

Robert M. Muraro | 47 | Chief Commercial Officer | |||||||

Jennifer R. Kneale | 45 | Chief Financial Officer | |||||||

| 64 | Executive Vice President, General Counsel and Secretary | |||||||

| |||||||||

Julie H. Boushka | 61 | Senior Vice President and Chief Accounting Officer | |||||||

Paul W. Chung | 64 | Chairman of the Board of Directors | |||||||

Joe Bob Perkins | 63 | Director | |||||||

| |||||||||

Rene R. Joyce | 76 | Director | |||||||

Charles R. Crisp | 76 | Director | |||||||

| |||||||||

Ershel C. Redd Jr.(2) | 76 | Director | |||||||

Laura C. Fulton | 60 | Director | |||||||

Waters S. Davis, IV | 70 | Director | |||||||

| |||||||||

Beth A. Bowman | 67 | Director | |||||||

Lindsey M. Cooksen | 41 | Director | |||||||

R. Keith Teague | 59 | Director | |||||||

Caron A. Lawhorn | 63 | Director | |||||||

| (1) | Ages as of |

| (2) | Mr. Redd will not be standing for reelection and is retiring from the Board, effective as of the date of the Annual Meeting, and therefore will no longer be considered a member of the Board as of the date of the Annual Meeting. |

Matthew J. Meloyhas served as Chief Executive Officer and a director of the Company andsince March 1, 2020. He also served as a director of Targa Resources GP LLC (the “General Partner”) of Targa Resources Partners LP (the “Partnership” or “TRP”) between March 2020 and May 2021. Mr. Meloy has also served as Chief Executive Officer of the General Partner since March 1, 2020. Mr. Meloy previously served asPresident of the Company and the General Partner between March 2018 and March 2020. Mr. Meloy also served as Executive Vice President and Chief Financial Officer of the Company and the General Partner between May 2015 and February 2018. He also served as Treasurer of the Company and the General Partner until December 2015. Mr. Meloy previously served as Senior Vice President, Chief Financial Officer and Treasurer of the Company between October 2010 and May 2015 and of the General Partner between December 2010 and May 2015. He also served as Vice President—Finance and Treasurer of the Company between April 2008 and October 2010, and as Director, Corporate Development of the Company between March 2006 and March 2008 and of the General Partner between March 2006 and March 2008. He served as Vice President—Finance and Treasurer of the General Partner between April 2008 and December 15, 2010. Mr. Meloy was with The Royal Bank of Scotland in the structured finance group, focusing on the energy sector from October 2003 to March 2006. Mr. Meloy’s extensive knowledge of the Company’s operational and strategic initiatives and capital investment program, attained from his service as President for two years and Chief Financial Officer for eight years, combined with his experience in the finance industry, brings operational, financial and capital markets experience to the Board.

Patrick J. McDonie has served as President—Gathering and Processing of the Company and the General Partner since March 2018. Mr. McDonie previously served as Executive Vice President—Southern Field Gathering and Processing of the Company and the General Partner between November 2015 and February 2018. He also

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 11 |

served as President of Atlas Pipeline Partners GP LLC (“Atlas”), which was acquired by the Partnership in February 2015, between October 2013 and February 2015. He also served as Chief Operating Officer of Atlas

8

between July 2012 and October 2013 and as Senior Vice President of Atlas between July 2012 and October 2013. He served as President of ONEOK Energy Services Company, a natural gas transportation, storage, supplier and marketing company between May 2008 and July 2012.

D. Scott Pryor has served as President—Logistics and Transportation of the Company and the General Partner, since March 2018. Mr. Pryor previously served as Executive Vice President—Logistics and Marketing of the Company and the General Partner between November 2015 and February 2018. He also served as Senior Vice President—NGL Logistics & Marketing of Targa Resources Operating LLC (“Targa Operating”) and various other subsidiaries of the Partnership between June 2014 and November 2015. He also served as Vice President of Targa Operating between July 2011 and May 2014 and has held officer positions with other Partnership subsidiaries since 2005.

Robert M. Muraro has served as Chief Commercial Officer of the Company and the General Partner since March 2018. Mr. Muraro previously served as Executive Vice President—Commercial of the Company and the General Partner between February 2017 and February 2018. He also served as Senior Vice President—Commercial and Business Development of Targa Midstream Services LLC (“Targa Midstream”) and various other subsidiaries of the Partnership between March 2016 and February 2017. He also served as Vice President—Commercial Development of Targa Midstream and various other subsidiaries of the Partnership between January 2013 and March 2016. He held the position of Director of Business Development between August 2004 and January 2013.

Jennifer R. Kneale has served as Chief Financial Officer of the Company and the General Partner since March 2018. She also served as Treasurer of the Company between September 2022 and April 2023 and of the General Partner between August 2022 and April 2023. Ms. Kneale previously served as Vice President—Finance of the Company and the General Partner between December 2015 and February 2018. She also served as Senior Director, Finance of the Company and the General Partner between March 2015 and December 2015. She also served as Director, Finance of the Company and the General Partner between May 2013 and February 2015. Ms. Kneale was with Tudor, Pickering, Holt & Co. in its energy private equity group, TPH Partners, from September 2011 to May 2013, most recently serving as Director of Investor Relations.2013.

Regina L. GregoryGerald R. Shrader has served as Executive Vice President, General Counsel and Secretary of the Company and the General Partner since March 1, 2020. Ms. Gregory previouslyDecember 2023. Prior to his appointment, Mr. Shrader served as Vice President and Assistant General Counselin various roles with subsidiaries of the Company and the General Partner between May 2019 andbeginning in March 2020 and of certain of the Company’s subsidiaries between April 2019 and March 2020. From June 2017 until joining the Company in July 2018, she was Senior Vice President, General Counsel and Corporate Secretary of Frontier Midstream Services IV LLC. She also served2015, most recently serving as Senior Vice President, General CounselCounsel—Southern Field G&P and Corporate Secretary for the general partner of American Midstream Partners, LP during 2016 and 2017.those subsidiaries. Prior to that, she was General Counsel, Vice President,joining Targa, Mr. Shrader served as Chief Legal Officer and Corporate Secretary of Traverse MidstreamAtlas Pipeline Partners LP inGP, LLC from October 2009 until March 2015 and, 2016prior to that time, served in various roles with affiliates of Atlas beginning in July 2007. Prior to Atlas, Mr. Shrader worked both for publicly traded energy companies and in private practice (including the general partner of Access Midstream Partners LP (previously Chesapeake Midstream Partners LP) from 2010 through 2015. Additionally, Ms. Gregory held a numberprovision of legal positions with different companies, including the law firms of Jones Dayservices to private and Fulbright & Jaworski (now Norton Rose Fulbright)publicly traded energy companies).

G. Clark White has served as Executive Vice President—Operations of the Company and the General Partner since September 2020 and served as Executive Vice President—Engineering and Operations of the Company and the General Partner between November 2015 and September 2020. Mr. White previously served as Senior Vice President—Field G&P of Targa Operating and various other subsidiaries of the Partnership between June 2014 and November 2015. He also served as Vice President of Targa Operating between July 2011 and May 2014 and has held officer positions with other Partnership subsidiaries since 2003.

Julie H. Boushka has served as Senior Vice President and Chief Accounting Officer of the Company and the General Partner since March 2019. Ms. Boushka previously served as Vice President—Controller of the Company, the General Partner and various subsidiaries of the Company between February 2017 and February 2019. She also served as Assistant Controller—Financial Accounting of the Company and the General Partner between November 2016 and February 2017. Ms. Boushka served as a Senior Vice President for Financial Planning and the Chief Risk Officer for Columbia Pipeline Group (“CPG”) between June 2015 and August 2016,

9

where she was responsible for the financial planning function and managing enterprise risk. She also served as the Business Unit Chief Financial Officer of CPG between May 2013 and June 2015, where she was responsible for the accounting and financial planning functions. Prior to that, Ms. Boushka spent approximately 18 years in various roles at El Paso Corporation (and its predecessor, Tenneco, Inc.), including accounting, financial reporting and business development.

Paul W. Chunghas served as a director and Chairman of the Board of the Company since January 1, 2021. Mr. Chung previously served as a director and Chairman of the Board of the General Partner sincebetween January 1,2021 and May 2021. From March 2020 until December 31, 2020, he served as Executive Vice President and Senior Legal Advisor of the Company. From May 2004 to March 2020, Mr. Chung served as Executive Vice President, General Counsel and Secretary of the Company and its predecessor entities and of the General Partner since its formation. From 1999 to May 2004, he served as Executive Vice President and General Counsel of various Shell Oil

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 12 |

Company (“Shell”) affiliates, including Coral Energy, LLC and Shell Trading North America Company. In these positions, Mr. Chung was responsible for all legal and regulatory affairs. From 1996 to 1999, he served as Vice President and Assistant General Counsel of Tejas Gas Corporation (“Tejas”).Corporation. Prior to 1996, Mr. Chung held a number of legal positions with different companies, including the law firm of Vinson & Elkins L.L.P. Mr. Chung’s knowledge of the Company, together with his background in the energy industry and his legal and regulatory experience, enable Mr. Chung to provide a valuable and distinct perspective to the Board on a range of business and management matters.

Joe Bob Perkins has served as a director of the Company and the General Partner since January 2012. Mr. Perkins previously served as Executive Chairman of the Board of the Company and the General Partner between March 1, 2020 and December 31, 2020, and as Chief Executive Officer of the Company and the General Partner between January 2012 and March 2020.2020, and as a director of the General Partner between January 2012 and May 2021. He also served as President of the Company between the date of its formation onin October 2005 and December 2011. Prior to 2005, Mr. Perkins served predecessor Targa companies as President since their founding in 2003. Prior to that, Mr. Perkins served in various leadership roles within the energy industry across several different companies, had employment experience with companies operating in both the midstream and upstream sectors, and was a management consultant with McKinsey & Company working primarily in energy. Mr. Perkins’ intimate knowledge of all facets of the Company, derived from his past services as Executive Chairman of the Board and as President and Chief Executive Officer, coupled with his broad experience in the energy industry, and specifically in the midstream sector, his engineering and business educational background, and his experience with the investment community, and experiences on other boards enable Mr. Perkins to provide a valuable and unique perspective to the Board on a range of business and management matters.

James W. Whalen Rene R. Joycehas served as a director of the Company since its formation in October 2005 and of the General Partner since February 2007. Mr. Whalen previously servedas Executive Chairman of the Board of the Company and the General Partner between January 2015 and March 2020. He also served as director of an affiliate of the Company during 2004 and 2005. Mr. Whalen previously served as Advisor to Chairman and CEO of the Company and the General Partner between January 2012 and December 2014. He served as Executive Chairman of the Board of the Company between October 2010 and December 2011 and of the General Partner between December 2010 and December 2011. He also served as President-Finance and Administration of the Company between January 2006 and October 2010 and the General Partner between October 2006 and December 2010 and for various Targa subsidiaries since November 2005. Between October 2002 and October 2005, Mr. Whalen served as the Senior Vice President and Chief Financial Officer of Parker Drilling Company. Between January 2002 and October 2002, he was the Chief Financial Officer of Diversified Diagnostic Products, Inc. He served as Chief Commercial Officer of Coral Energy Holding, L.P. (“Coral”) from February 1998 through January 2000. Previously, he served as Chief Financial Officer for Tejas from 1992 to 1998. Mr. Whalen brings a breadth and depth of experience as an executive, Board member, and audit committee member across several different companies and in energy and other industry areas. His valuable management and financial expertise includes an understanding of the accounting and financial matters that the Company and industry address on a regular basis.

Rene R. Joyce has served as a director of the Company since its formation in October 2005 and of the General Partner since October 2006. Mr. Joyce previously served as Executive Chairman of the Board of the Company and the General Partner between January 2012 and December 2014.2014 and as a director of the General Partner between October 2005 and May 2021. He also served as Chief Executive Officer of the

10

Company between October 2005 and December 2011 and the General Partner between October 2006 and December 2011. He also served as an officer and director of an affiliate of the Company during 2004 and 2005 and was a consultant for the affiliate during 2003. Mr. Joyce isserved as a director of Apache Corporation.APA Corporation (NASDAQ: APA) between May 2017 and May 2021. Mr. Joyce served as a consultant in the energy industry from 2000 through 2003 providing advice to various energy companies and investors regarding their operations, acquisitions and dispositions. Mr. Joyce served as President of onshore pipeline operations of Coral Energy, LLC, a subsidiary of Shell from 1998 through 1999 and President of energy services of Coral, a subsidiary of Shell which was the gas and power marketing joint venture between Shell and Tejas, during 1999. Mr. Joyce served as President of various operating subsidiaries of Tejas, a natural gas pipeline company, from 1990 until 1998 when Tejas was acquired by Shell. As the founding Chief Executive Officer of the Company, Mr. Joyce brings deep experience in the midstream business, expansive knowledge of the oil and gas industry, as well as relationships with chief executives and other senior management at peer companies, customers and other oil and natural gas companies throughout the world. His experience and industry knowledge, complemented by an engineering and legal educational background, enable Mr. Joyce to provide the Board with executive counsel on the full range of business, technical, and professional matters.

Charles R. Crisp has served as a director of the Company since its formation in October 2005 and2005. He also served as a director of the General Partner sincebetween March 2016. He also served as2016 and May 2021 and a director of an affiliate of the Company during 2004 and 2005. Mr. Crisp was President and Chief Executive Officer of Coral Energy, LLC, a subsidiary of Shell, from 1999 until his retirement in November 2000, and was President and Chief Operating Officer of Coral from January 1998 through February 1999. Prior to this, Mr. Crisp served as President of the power generation group of Houston Industries and, between 1988 and 1996, as President and Chief Operating Officer of Tejas. Mr. Crisp is a director of EOG Resources Inc. (NYSE: EOG). He was also a director of Intercontinental Exchange Inc. (NYSE: ICE) from 2002 until May 2022 and Southern Company Gas (formerly known as AGL Resources Inc.), a subsidiary of The Southern Company EOG Resources Inc. and Intercontinental Exchange Inc.(NYSE: SO), from 2003 until April 2023. Mr. Crisp brings extensive energy experience, a vast understanding of many aspects of our industry and experience serving on the boards of other public companies in the energy industry. His leadership and business experience and deep knowledge of various sectors of the energy industry bring a crucial insight to the Board.

Chris Tong has served as a director of the Company since January 2006 and of the General Partner since March 2016. Mr. Tong served as a director of Kosmos Energy Ltd. from 2011 until September 2019. He served as Senior Vice President and Chief Financial Officer of Noble Energy, Inc. from January 2005 until August 2009. He also served as Senior Vice President and Chief Financial Officer for Magnum Hunter Resources, Inc. from August 1997 until December 2004. Prior thereto, he was Senior Vice President of Finance of Tejas Acadian Holding Company and its subsidiaries, including Tejas Gas Corp., Acadian Gas Corporation and Transok, Inc., all of which were wholly-owned subsidiaries of Tejas. Mr. Tong held these positions from August 1996 until August 1997, and had served in other treasury positions with Tejas since August 1989. Mr. Tong brings a breadth and depth of experience as a chief financial officer in the energy industry, a financial executive, a director of other public companies and a member of other audit committees. He brings significant financial, capital markets and energy industry experience to the Board.

Ershel C. Redd Jr. has served as a director of the Company since February 2011 and2011. Mr. Redd previously served as a director of the General Partner sincebetween March 2016.2016 and May 2021. Mr. Redd has served as a consultant in the energy industry since 2008 providing advice to various energy companies and investors regarding their operations,

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 13 |

acquisitions and dispositions. Mr. Redd was President and Chief Executive Officer of El Paso Electric Company, a public utility company, from May 2007 until March 2008. Prior to this, Mr. Redd served in various positions with NRG Energy, Inc., a wholesale energy company, including as Executive Vice President—Commercial Operations from October 2002 through July 2006, as President—Western Region from February 2004 through July 2006, and as a director between May 2003 and December 2003. Mr. Redd served as Vice President of Business Development for Xcel Energy Markets, a unit of Xcel Energy Inc., from 2000 through 2002, and as President and Chief Operating Officer for New Century Energy’s (predecessor to Xcel Energy Inc.) subsidiary, Texas Ohio Gas Company, from 1997 through 2000. Mr. Redd brings to the Company extensive energy industry experience, a vast understanding of varied aspects of the energy industry and experience in corporate performance, marketing and trading of natural gas and natural gas liquids,NGLs, risk management, finance, acquisitions and divestitures, business development,

11

regulatory relations and strategic planning. His leadership and business experience and deep knowledge of various sectors of the energy industry bring a crucial insight to the Board.

Laura C. Fulton has served as a director of the Company since February 2013 and2013. Ms. Fulton previously served as a director of the General Partner since March 2016.between February 2013 and May 2021. Ms. Fulton has served as the Senior Vice President Financeand Chief Financial Officer of the American Bureau of Shipping since July 2021 and previously served as the Vice President of Finance from January 2020.2020 until July 2021. Ms. Fulton served as the Chief Financial Officer of Hi-Crush Proppants LLC from April 2012 until December 2019 and Hi-Crush GP LLC, the general partner of Hi-Crush Partners LP, from May 2012 until May 2019 and its successor, Hi-Crush Inc., from May 2019 to December 2019. OnDuring July 12, 2020, Hi-Crush Inc. and each of its direct and indirect wholly-owned domestic subsidiaries (including Hi-Crush Proppants LLC) (collectively, “Hi-Crush”) filed for protection under Chapter 11 of the Federal Bankruptcy Code. OnDuring October 9, 2020, Hi-Crush’s Chapter 11 Plan of Reorganization was confirmed. From March 2008 to October 2011, Ms. Fulton served as Executive Vice President, Accounting and then Executive Vice President, Chief Financial Officer of AEI Services, LLC (“AEI”), an owner and operator of essential energy infrastructure assets in emerging markets. Prior to AEI, Ms. Fulton spent 12 years with Lyondell Chemical Company in various capacities, including as general auditor responsible for internal audit and the Sarbanes-Oxley certification process, and as the assistant controller. Prior to that, she spent 11 years with Deloitte & Touche in public accounting, with a focus on audit and assurance. As a chief financial officer, general auditor and external auditor, Ms. Fulton brings to the company extensive financial, accounting and compliance process experience. Ms. Fulton’s experience as a financial executive in the energy industry, including her positions with a publicly-traded company and master limited partnership, also brings industry and capital markets experience to the Board.

Waters S. Davis, IV has served as director of the Company since July 2015 and2015. Mr. Davis previously served as a director of the General Partner sincebetween March 2016. Mr. Davis has served2016 and May 2021 and as President of National Christian Foundation, Houston sincefrom July 2014.2014 until December 2020. Mr. Davis was Executive Vice President of NuDevco LLC (“NuDevco”) from December 2009 to December 2013. Prior to his employment with NuDevco, he served as President of Reliant Energy Retail Services from June 1999 to January 2002 and as Executive Vice President of Spark Energy from April 2007 to November 2009. He previously served as a senior executive at a number ofseveral private companies and as an advisor to a private equity firm, providing operational and strategic guidance. Mr. Davis also serves as a director of Milacron Holdings Corp. Mr. Davis brings expertise in the retail energy, midstream and services industries, which enhances his contributions to the Board.

Robert B. EvansBeth A. Bowman has served as a director of the Company since March 2016 and of the General Partner since February 2007. Mr. Evans is also a director of New Jersey Resources Corporation and One Gas, Inc. Mr. Evans was a director of Sprague Resources GP LLC until OctoberSeptember 2018. Mr. Evans was the President and Chief Executive Officer of Duke Energy Americas, a business unit of Duke Energy Corp., from January 2004 until his retirement in March 2006. Mr. Evans served as the transition executive for Energy Services, a business unit of Duke Energy, during 2003. Mr. Evans also served as President of Duke Energy Gas Transmission beginning in 1998 and was named President and Chief Executive Officer in 2002. Prior to his employment at Duke Energy, Mr. Evans served as Vice President of marketing and regulatory affairs for Texas Eastern Transmission and Algonquin Gas Transmission from 1996 to 1998. Mr. Evans’ extensive experience in the gas transmission and energy services sectors enhances the knowledge of the Board in these areas of the oil and gas industry. As a former President and CEO of various operating companies, his breadth of executive experiences is applicable to many of the matters routinely facing the Partnership.

Beth A.Ms. Bowman has previously served as a director of the Company and the General Partner sincebetween September 2018.2018 and May 2021. Ms. Bowman has served as a director of Sprague Resources GP LLC, the general partner of Sprague Resources LP (“Sprague”), sincefrom October 2014 and she currently serves on the Audit Committee of Sprague.until November 2022. Ms. Bowman held management positions at Shell Energy North America (US) L.P. (“Shell Energy”) for 17 years until her retirement in September 2015. While at Shell Energy, she held the roles of Senior Vice President of the West and Mexico and later as the Senior Vice President of Sales and Origination for Shell’s North America business. Prior to joining Shell Energy, Ms. Bowman held management positions at Sempra Energy Trading and Sempra’s San Diego Gas & Electric utility in various areas including trading and marketing, risk management, fuel and power supply, regulatory, finance and engineering. Ms. Bowman also served on the board of the California Power Exchange and the board of the California Foundation of Energy and Environment from 2004 until 2015.

12

Ms. Bowman’s extensive energy industry background, including her experience in origination, commodities markets and risk management enhances the knowledge of the Board in these areas of the oil and gas industry.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 14 |

Lindsey M. Cooksen has served as a director of the Company andsince June 2020. Ms. Cooksen previously served as a director of the General Partner sincebetween June 1, 2020.2020 and May 2021. Ms. Cooksen has served as the founder and managing director of Cooksen Wealth, LLC, a wealth management firm, since April 2019. She previously held various positions with Morgan Stanley Private Wealth Management (“Morgan Stanley”) from August 2009 to April 2019. While at Morgan Stanley she held the roles of Private Wealth Advisor, Family Wealth Director and Portfolio Management Director. She also previously worked for Citigroup Global Investment Bank between July 2005 and August 2007. Ms. Cooksen’s extensive corporate experience in the financial services industry, including wealth management and portfolio construction, tax planning and analysis and risk mitigation brings financial experience and an investor’s perspective to the Board.

R. Keith Teague has served as a director of the Company since February 2024. Mr. Teague served as the Chief Operating Officer of Tellurian, Inc. and its predecessors from October 2016 to July 2022. Prior to joining Tellurian Investments LLC, Mr. Teague served in various leadership roles at Cheniere Energy Inc. (“Cheniere”), including Executive Vice President, Asset Group from February 2014 to September 2016, Senior Vice President – Asset Group from April 2008 to February 2014, Vice President – Pipeline Operations from May 2006 to April 2008, and Director of Facility Planning from February 2004 to May 2006. From December 2001 to September 2003, Mr. Teague served as the Director of Strategic Planning for the CMS Panhandle Companies. He began his career with Texas Eastern Transmission Corporation, where he managed pipeline operations and facility expansion projects. Mr. Teague previously served as a director on the Board of Cheniere Energy Partners, L.P. (NYSE: CQP), a publicly traded subsidiary partnership of Cheniere, from April 2008 to October 2016 and previously served on the Board of Directors for the Interstate Natural Gas Association of America (INGAA), and the Board and Executive Committee of the INGAA Foundation. Mr. Teague’s engineering and business educational background, his experience on a publicly traded partnership Board, and his extensive project execution experience provide the Board with valued perspective related to energy infrastructure development and operations.

Caron A. Lawhorn has served as a director of the Company since March 2024. Ms. Lawhorn served as Senior Vice President and Chief Financial Officer of ONE Gas, Inc. (NYSE: OGS) from March 2019 until her retirement in December 2023. Prior to that role, Ms. Lawhorn served at OGS as Senior Vice President, Commercial, responsible for the commercial activities of OGS’ three natural gas distribution utilities, as well as overseeing the company’s information technology and cybersecurity function, from OGS’ separation from ONEOK, Inc. (NYSE: OKE) into a standalone, publicly traded company in January 2014. Ms. Lawhorn served in the same role at OKE prior to the separation. Before that, she served as President of OKE’s natural gas distribution segment. From July 2009 until March 2011, she served as Senior Vice President, Corporate Planning and Development of OKE and ONEOK Partners, responsible for business development, strategic and long-range planning, and capital investment. Ms. Lawhorn became Senior Vice President and Chief Accounting Officer for OKE in 2007, adding responsibility for ONEOK Partners in 2008. Prior to that, she served as Senior Vice President of Financial Services and Treasurer of OKE. Ms. Lawhorn joined OKE in 1998, after serving as a Senior Manager at KPMG and Chief Financial Officer of Emergency Medical Services Authority in Tulsa. She also serves a director of AAON, Inc. (NASDAQ: AAON), where she has chaired the audit committee since 2019. Ms. Lawhorn’s extensive background in various accounting, finance, operational and executive positions, including her experience as a financial executive of a publicly traded energy company, provides the Board with significant accounting and financial expertise. Additionally, Ms. Lawhorn’s previous experience in overseeing information technology and cybersecurity matters also provides the Board with valuable cybersecurity experience.

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 15 |

Summary of Director Qualifications and Experience

This table provides a summary view of the qualifications and attributes of each director and director nominee.

| Directors | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Directors | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|  |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||||||||||||||||||||||||||||

Knowledge, Skills, Experience

| Knowledge, Skills, Experience |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Accounting | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Business Operations | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital Management | • | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||

Corporate Governance Leadership | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Cybersecurity | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Executive Experience | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||

Financial Expertise | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||

HR / Compensation | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Independence | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Industry Experience | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||

Legal / Regulatory | • | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||

Mergers & Acquisitions | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||

Public Company Board Experience | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Risk Management | • | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||

Strategic Planning / Oversight | • | • | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||

Demographic Background

| Demographic Background |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

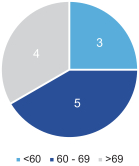

Targa Board Tenure (Years)1 | 2 | 0 | 1 | 10 | 5 | 4 | 7 | 10 | 1 | 8 | 9 | 10 | 10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Targa Board Tenure (Years) (1) | 5 | 3 | 4 | 13 | 8 | 11 | 13 | 0 | 4 | 12 | 13 | 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gender (Male / Female) | F | M | F | M | M | M | F | M | M | M | M | M | M | F | M | F | M | M | F | M | F | M | M | M | M | |||||||||||||||||||||||||||||||||||||||||||||||||

Race / Ethnicity

| Race / Ethnicity |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Asian / Pacific Islander | • | ∎ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Black | • | ∎ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Caucasian / White | • | • | • | • | • | • | • | • | • | • | • | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Hispanic / Latino | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Native American

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1)

| (1) | As of the date of the Annual Meeting. Tenure calculated from the closing date of the Targa initial public offering. |

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 16 |

Board Composition and Governance Highlights

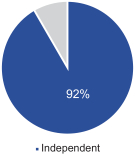

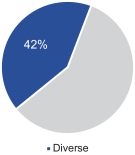

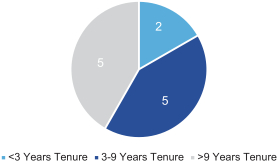

| 92% Board Independence | 42% Board Diversity | |

|

| |

| Average Tenure = 7.5 Years(1) | Average Age = 63.4 | |

|

| |

13

| (1) | As of the date of the Annual Meeting. Tenure calculated from the closing date of the Targa initial public offering. |

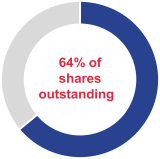

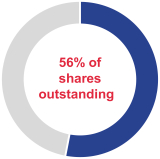

96% Support on Say on Pay in 2023 | 100% Independent Audit, Compensation, and |

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 17 |

MEETINGS AND COMMITTEES OF DIRECTORS

Board of Directors

Our Board of Directors currently consists of thirteentwelve members. The Board of Directors reviewed the independence of our directors using the independence standards of the New York Stock Exchange (“NYSE”) and various other factors discussed under “Director Independence” and, based on this review, determined that Mses. Bowman, Cooksen, and Fulton and Lawhorn and Messrs. Chung, Crisp, Davis, Evans, Joyce, Perkins, Redd and TongTeague are independent within the meaning of the NYSE listing standards currently in effect. On February 26, 2024, Mr. Evans resigned from the Board. Mr. Redd will not be standing for reelection and is retiring from the Board, effective as of the date of the Annual Meeting. The Board held eleveneight meetings during 2020.2023. In addition, the independent members of the Board of Directors meet in executive session without the presence of the CEO or other members of management at least once annually. During 2020,2023, each of the directors that served on the Board of Directors during the year attended at least 75%100% of the aggregate of the total number of meetings of the Board and the total number of meetings of all committees of the Board on which that director served.

Our directors are divided into three classes serving staggered three-year terms. Class I, Class II and Class III directors will serve until our annual meetings of stockholders in 2023, 20212026, 2024 and 2022,2025, respectively. The Class I directors are Messrs. Chung, Crisp and WhalenTeague and Ms. Fulton, the Class II directors are Messrs. Evans, Redd (who is retiring from the Board and will not be standing for reelection) and Perkins and Mses. Bowman and Cooksen and the Class III directors are Messrs. Davis, Joyce and Meloy and Tong.Ms. Lawhorn. At each annual meeting of stockholders, directors will be elected to succeed the class of directors whose terms have expired. This classification of our Board of Directors could have the effect of increasing the length of time necessary to change the composition of a majority of the Board of Directors. In general, at least two annual meetings of stockholders will be necessary for stockholders to effect a change in a majority of the members of the Board of Directors.

Committees of the Board of Directors

Our Board of Directors has a standing Audit Committee, Compensation Committee, Nominating and Governance Committee, Risk Management Committee and Sustainability Committee, and may have such other committees as the Board of Directors shall determine from time to time. Each of the standing committees of the Board of Directors has the composition and responsibilities described below.

Audit Committee

The members of our Audit Committee are Mses. Cooksen and Fulton, Lawhorn and Mr. Evans.Teague. Ms. Fulton is the Chairman of this committee. Our Board of Directors has affirmatively determined that Mses. Cooksen and Fulton and Mr. Evans areeach of the members of the Audit Committee is independent as described in the rules of the NYSE and the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board of Directors has also determined that, based upon relevant experience, Ms. Fulton is an “audit committee financial expert” as defined in Item 407 of Regulation S-K.

This committee oversees, reviews, acts on and reports on various auditing and accounting matters to our Board of Directors, including: the selection of our independent auditors, the scope of our annual audits, fees to be paid to the independent auditors, the performance of our independent auditors and our accounting practices. In addition, theThe Audit Committee oversees our compliance programs relating to legal and regulatory requirements and our cybersecurity efforts and measures. Committee:

| ∎ | Oversees, reviews, acts on and reports on various auditing and accounting matters to our Board of Directors, including: the selection of our independent auditors, the scope of our annual audits, fees to be paid to the independent auditors, the performance of our independent auditors and our accounting practices; |

| ∎ | Oversees our compliance programs relating to legal and regulatory requirements; |

| ∎ | Reviews and acts on, as necessary, related party transactions, pursuant to our policies and procedures and applicable accounting standards; and |

| ∎ | Reviews our risk management program regarding enterprise-wide risks (including those associated with ESG policies, trends, and issues) and mitigants and reviews risks and initiatives relating to data privacy, cybersecurity and information technology. |

| Targa Resources Corp.|Proxy Statement|2 0 2 4 A N N U A L M E E T I N G O F S T O C K H O L D E R S | 18 |

We have adopted an Audit Committee charter defining the committee’s primary duties in a manner consistent with the rules of the SEC and NYSE that is posted on the Company’s website at www.targaresources.com/investors/corporate-governance. The Audit Committee held four meetings during 2020.2023.

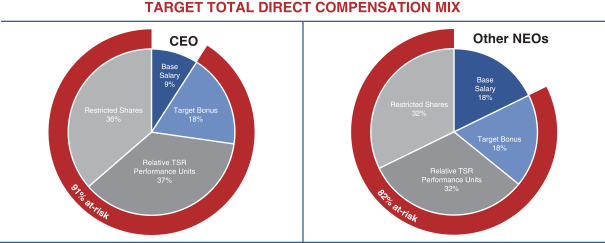

Compensation Committee

The members of our Compensation Committee are Messrs. Crisp, DavisMr. Teague and EvansMses. Cooksen and Bowman. Ms. Bowman. Mr. DavisBowman is the Chairman of this committee. This committee establishes salaries, incentives and other forms of compensation for officers, directors and other employees. This includes establishing our ESG-linked compensation program, which aims to align executive compensation with sustainability goals and targets, and assessing our ESG performance. Our Compensation Committee also administers our incentive compensation and benefit plans.plans, and oversees our clawback policy. We have adopted a Compensation Committee charter defining the committee’s

14

primary duties in a manner consistent with the rules of the SEC and NYSE that is posted on the Company’s website at www.targaresources.com/investors/corporate-governance. The Compensation Committee held fourfive meetings during 2020.2023. Our Board of Directors has determined that each of the members of the Compensation Committee is (i) independent under the NYSE’s rules governing Compensation Committee membership; and (ii) a “non-employee director” under Rule 16b-3 of the Exchange Act.